Dalle generated image of cobalt mines in DRC showing elements of artisanal mining of cobalt in the DRC

Supply chain-related Scope 3 emissions are significantly larger than those from direct operations, accounting for 26 times the emissions found in Scopes 1 and 2. In fact, the reported upstream emissions from key industries such as manufacturing, retail, and materials surpass the total CO₂ emissions recorded in the European Union in 2022 by a factor of 1.4.[1] Despite their overwhelming contribution to overall carbon footprints, supply chain emissions remain largely neglected. Companies are twice as likely to measure their direct operational emissions under Scopes 1 and 2 compared to their supply chain emissions under Scope 3. Additionally, businesses are 2.4 times more likely to set reduction targets for operational emissions than for those originating in their supply chains. As a result, only 15% of companies reporting to the Carbon Disclosure Project (CDP) have established upstream Scope 3 reduction targets, underscoring a critical gap in corporate decarbonization efforts. As global regulators intensify climate disclosure requirements, Scope 3 emissions reporting has transitioned from a voluntary best practice to an operational necessity. The European Union’s Corporate Sustainability Reporting Directive (CSRD) mandates full value chain emissions accounting for nearly 50,000 companies by 2025, reflecting a paradigm shift in corporate sustainability obligations.

Similarly, California’s SB 253 requires Scope 3 disclosure for companies with revenue exceeding $1 billion by 2027, reinforcing the necessity for robust emissions accounting frameworks.[2] Businesses now face a complex landscape shaped by expanding disclosure mandates, divergent regulatory standards, and increasing supply chain complexity. Approximately 92% of global corporate emissions now fall under Scope 3 reporting requirements across major jurisdictions, leading to mounting pressure on corporations to develop sophisticated emissions tracking methodologies. The contrast between the U.S. Securities and Exchange Commission’s scaled-back disclosure requirements, California’s all-encompassing mandate, and the CSRD’s double materiality framework exemplifies the challenges that companies must navigate in achieving compliance. Additionally, multinational corporations often engage with intricate supply chains, where emissions must be tracked across thousands of suppliers at different tiers, increasing both the complexity and risk of inaccuracies in reporting.

The Hidden Costs of Current Approaches

Most organizations face significant inefficiencies in their current Scope 3 emissions reporting methods, which rely heavily on manual data collection, estimated emission factors, and retroactive compliance reporting. These outdated approaches introduce substantial errors, inflate compliance costs, and hinder decarbonization efforts by failing to identify critical emissions hotspots within supply chains. Without a precise and proactive framework, companies risk regulatory penalties, reputational damage, and lost opportunities for supply chain optimization and emissions reduction.

Manual data collection from suppliers often results in inconsistent and incomplete emissions data due to varying levels of reporting capabilities across suppliers. Many small and mid-sized suppliers lack the necessary expertise, technology, or incentives to provide accurate emissions data, leading to significant discrepancies. Additionally, collecting and verifying emissions data manually is labor-intensive, increasing administrative burdens and costs while leaving room for human errors and fraudulent reporting. The inefficiency of this process makes it difficult for companies to meet stringent reporting deadlines and align with global regulatory requirements.

Currently, most organizations rely on manual data collection from suppliers, estimated emission factors, and retroactive compliance reporting. These methods are fraught with inefficiencies, inaccuracies, and missed opportunities for emissions reductions. Studies indicate that Scope 3 emissions calculations can have error margins as high as 43%, severely undermining the reliability of reported data. Furthermore, compliance is costly, with mid-cap firms incurring an average annual compliance cost of $2.4 million, which often acts as a deterrent for proactive investment in emissions reduction initiatives. Beyond compliance, ineffective reporting mechanisms result in missed decarbonization opportunities, as companies lack the granular insights necessary to identify and mitigate high-impact supply chain emissions.

The absence of standardized, verifiable data further complicates Scope 3 emissions management. Supply chain emissions are frequently underreported due to a lack of supplier engagement, insufficient verification protocols, and fragmented regulatory frameworks across jurisdictions. Without precise data, corporations struggle to implement meaningful decarbonization strategies, leading to an overreliance on industry averages and generic emission factors that fail to capture the nuances of specific supply chains. This challenge is particularly pronounced in high-impact industries such as agriculture and mining, where emissions sources vary significantly across regions and operational processes.

Estimated emission factors are widely used as a proxy when supplier-specific data is unavailable, but they introduce significant inaccuracies into Scope 3 calculations. These generalized industry averages fail to account for variations in production methods, energy sources, and regional environmental impacts. As a result, companies relying on emission factors often misrepresent their actual carbon footprint, leading to misinformed sustainability strategies. Furthermore, regulators and investors are increasingly demanding higher data granularity, making it crucial for companies to transition from estimations to primary data collection.

Retroactive compliance reporting places companies in a reactive rather than proactive position, reducing their ability to mitigate emissions in real time. Since Scope 3 emissions are reported retrospectively, organizations often miss opportunities to implement supply chain improvements that could drive significant reductions. This delayed approach results in higher compliance costs, as companies are forced to spend additional resources on correcting reporting inaccuracies and meeting evolving regulatory expectations. Moreover, by the time emissions data is compiled and reported, many decarbonization opportunities have already been lost, limiting the impact of corporate sustainability initiatives.

These inefficiencies lead to 43% error margins in Scope 3 calculations, making reported emissions data unreliable for decision-making and compliance. Additionally, mid-cap firms face an average annual compliance cost of $2.4 million, a significant financial burden that diverts resources from strategic sustainability investments. Perhaps most critically, organizations relying on flawed reporting methodologies miss crucial decarbonization opportunities in high-impact supply chain nodes, undermining their ability to achieve long-term emissions reduction goals and improve supply chain resilience. To address these challenges, companies must adopt a data-driven, automated, and forward-looking emissions management approach that ensures accuracy, compliance, and meaningful sustainability progress.

A Precision-Based Framework for Scope 3 Management

Given these challenges, companies must adopt a more sophisticated, data-driven approach to Scope 3 emissions reporting. Implementing a precision-based framework can significantly enhance compliance efficiency and emissions reduction effectiveness. One critical component of such a framework is an automated regulatory monitoring system capable of tracking evolving disclosure requirements across multiple jurisdictions. By integrating dynamic, auto-updating tracking tools, businesses can stay ahead of regulatory changes and ensure alignment with international reporting standards.

Another key innovation is the development of a materiality matrix builder, which aligns with CSRD’s double materiality framework. This tool enables companies to prioritize emissions reduction efforts based on financial and environmental impact, facilitating more targeted interventions within supply chains. Additionally, a structured supplier capacity program is essential for ensuring that vendors are equipped to provide accurate and consistent emissions data. By implementing a structured onboarding process, companies can integrate a majority of their suppliers into climate reporting within a short timeframe, enhancing overall data accuracy and consistency.

For companies operating in jurisdictions with stringent emissions disclosure requirements, such as California, tailored compliance solutions can streamline reporting processes. Pre-built reporting templates designed to meet the California Air Resources Board (CARB) monitoring protocols can significantly reduce administrative burdens and accelerate compliance timelines.[3] Integrated legal review workflows further support companies by ensuring that climate risk disclosures adhere to evolving regulatory requirements. Moreover, supplier transition financing models can incentivize upstream and downstream partners to invest in emissions reduction initiatives, ultimately lowering Scope 3 baselines and improving sustainability performance.

Floodlight’s Industry-Specific Approaches to Scope 3 Reporting

The challenges of Scope 3 reporting are particularly pronounced in industries such as agriculture and mineral processing, where supply chains span multiple jurisdictions and involve complex emissions sources. Floodlight has analyzed two types of supply chains in the palm oil industry in Indonesia and the extraction and processing of rare earth minerals in the Democratic Republic of the Congo (DRC). These sectors present unique challenges in emissions tracking, requiring specialized methodologies to ensure accurate reporting and compliance.

In the case of palm oil production, emissions arise from various sources, including land-use change, deforestation, agricultural inputs, processing facilities, and transportation. A comprehensive Scope 3 emissions assessment for palm oil companies begins with a robust data collection strategy. Data on palm oil plantations, mills, and refineries is essential for analyzing Scope 3 emissions related to land-use emissions, fertilizer application, and processing energy consumption. [4]Satellite imagery and remote sensing technologies provide additional verification for land-use changes, helping companies estimate emissions from deforestation and peatland conversion. Additionally, life-cycle assessment (LCA) methodologies are used to quantify emissions across the supply chain, ensuring that emissions factors reflect the specific production and processing conditions in Indonesia.

Dalle generated image of palm plantations, which are in close proximity to protected forests. The palm oil plantations are the first step in Scope 3 emission estimation. Wildlife such as orangutans are impacted by increased deforestation and biodiversity loss. The next step in the supply chain is the refineries where palm oil is extracted. The final part of the supply chain is the manufacture of diverse range of products including cooking oil, cosmetics, biodegradable goods.

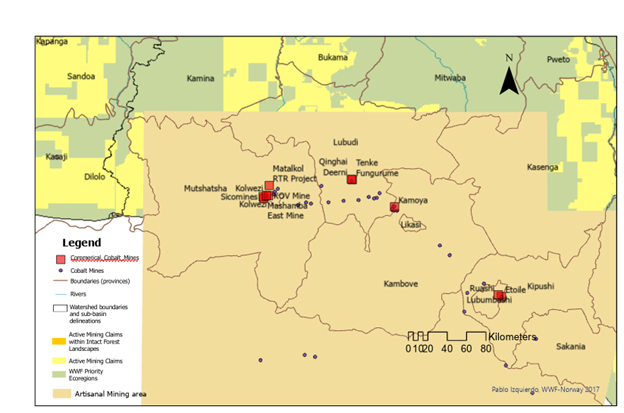

For rare earth minerals sourced from the DRC, emissions reporting is complicated by fragmented supply chains, artisanal mining activities, and geopolitical risks. The extraction and processing of rare earth minerals involve substantial greenhouse gas emissions due to the energy-intensive nature of mining and refining operations. Floodlight’s data collection efforts will include engagement with local mining cooperatives, industrial mining firms, and smelting facilities to obtain emissions data on ore extraction, transportation, and chemical processing. Floodlight (as shown below in Figure 1) considers intact forest areas and emissions arising from deforestation due to mining, if applicable. Given the prevalence of informal mining operations, emissions estimates may need to incorporate secondary data sources, such as environmental impact assessments and governmental reports, to improve accuracy. Satellite imagery and drone technology will assist in evaluating the mines Scope 1 emissions. Additionally, blockchain technology offers a potential solution for tracking emissions along mineral supply chains, providing transparency and traceability from extraction to final product manufacturing.

Figure 1: This map highlights the locations of commercial cobalt mines in the Democratic Republic of the Congo (DRC) alongside key environmental features, including: Active mining claims within intact forest landscapes (light yellow areas) and WWF priority ecoregions (green areas). Commercial cobalt mines are identified on the map; artisanal mining areas (brown/beige); Rivers and watershed boundaries (blue lines).

In the DRC, Cobalt mining is primarily associated with large-scale copper mining operations, such as: Tenke Fungurume Mine (China Molybdenum – CMOC), Mutanda Mine (Glencore), Kamoto Copper Company (KCC) (Glencore) and Metalkol RTR Project (Eurasian Resources Group – ERG). The United States has shown a growing interest in the Democratic Republic of Congo’s (DRC) mining sector, primarily due to the country’s abundant reserves of critical minerals essential for advanced technologies. In recent developments, the U.S. has engaged in exploratory discussions with the DRC regarding potential partnerships to access these critical minerals. These talks aim to secure mineral exploration rights in exchange for supporting the Congolese government led by President Félix Tshisekedi, who is currently addressing armed conflicts in the eastern regions of the country.[5] A significant factor driving U.S. interest is the current dominance of Chinese companies in the DRC’s mining industry. Chinese firms control a substantial portion of large-scale mining operations, leading to concerns about supply chain dependencies for essential minerals. By establishing direct partnerships with the DRC, the U.S. aims to diversify its sources of critical minerals, thereby reducing reliance on Chinese-controlled supply chains.[6] Furthermore, the U.S. has expressed intentions to promote responsible and transparent development of the DRC’s mineral resources. This approach aligns with broader efforts to ensure ethical sourcing of minerals, addressing issues such as human rights abuses and environmental degradation associated with mining activities.[7]

Floodlight utilizes blockchain technology in estimating Scope 3 emissions in these sectors requires a combination of primary data collection, modeled emission factors, and verification mechanisms. Companies can leverage digital supply chain platforms to aggregate emissions data across suppliers and identify high-emission hotspots. Supplier audits, third-party verification, and industry collaborations can further enhance data reliability. Furthermore, scenario analysis and sensitivity testing can help companies refine their emissions estimates, accounting for potential variations in supplier practices and market conditions.

Strategic and Financial Implications of Scope 3 Management

By adopting a rigorous, data-driven approach to Scope 3 emissions management, companies can achieve significant strategic and financial benefits. Accelerated compliance timelines, enhanced data transparency, and improved stakeholder engagement contribute to a more resilient and sustainable supply chain. Additionally, proactive Scope 3 management can facilitate access to green financing mechanisms, such as sustainability-linked loans and carbon credit markets, providing financial incentives for emissions reduction initiatives.

Investors and ESG rating agencies are increasingly scrutinizing corporate sustainability performance, making comprehensive emissions reporting a critical differentiator in capital markets. Companies that demonstrate leadership in Scope 3 management can enhance their market positioning, attract sustainability-focused investors, and mitigate regulatory and reputational risks. Furthermore, effective emissions reduction strategies can drive cost savings through energy efficiency improvements, waste reduction initiatives, and supply chain optimization.

As regulatory frameworks continue to evolve, companies must embrace advanced Scope 3 emissions management strategies to remain competitive in a rapidly shifting sustainability landscape. Moving beyond compliance to integrate emissions reduction into core business strategy will be essential for building long-term resilience and creating value in a carbon-constrained economy.

The Bottom Line

By 2025, Scope 3 emissions management will evolve from a mere compliance requirement into a strategic imperative for businesses seeking to enhance resilience, secure financing, and differentiate themselves in the market. As regulatory landscapes become more stringent and investor scrutiny intensifies, companies must shift from reactive compliance-driven reporting to proactive emissions management. This transition will enable businesses to leverage Scope 3 reporting as a tool for building supply chain resilience, unlocking green financing opportunities, and strengthening their competitive positioning.

A robust Scope 3 management strategy serves as a supply chain resilience lever, allowing businesses to mitigate climate risks, enhance transparency, and drive supplier engagement. Organizations that integrate emissions tracking into supply chain decision-making can identify high-impact areas for decarbonization, improve supplier accountability, and establish long-term sustainability partnerships. By embedding emissions reduction efforts within procurement and operational strategies, companies will be better equipped to navigate regulatory pressures and supply chain disruptions.

Moreover, Scope 3 reporting is increasingly recognized as a green financing enabler, facilitating access to sustainability-linked financial instruments and investment opportunities. Financial institutions are prioritizing companies with strong ESG performance, rewarding those that demonstrate tangible emissions reduction efforts with lower borrowing costs and favorable investment terms. By adopting data-driven, auditable emissions reporting practices, businesses can enhance investor confidence and capitalize on emerging green finance mechanisms, such as sustainability bonds and carbon credit markets.

Lastly, effective Scope 3 emissions management serves as a market differentiation asset, reinforcing corporate credibility and strengthening stakeholder trust. Companies that proactively measure, report, and reduce their supply chain emissions can distinguish themselves as sustainability leaders, enhancing brand reputation and customer loyalty. As consumers and investors increasingly prioritize climate-conscious businesses, those that transparently disclose emissions and implement measurable reductions will gain a competitive edge in their industries.

Floodlight provides the technical infrastructure and cross-jurisdictional expertise to transform the reporting burden into a value-generating engine. We empower forward-thinking companies to integrate cutting-edge data methodologies into their sustainability strategies, ensuring accurate emissions tracking, improved risk management, and enhanced stakeholder communication. By adopting our approach, businesses can demonstrate that their climate commitments are strategic, well-executed, and aligned with the highest industry standards.

Guidance on Allocating Upstream Supplier Emissions

To ensure consistency and transparency in Scope 3 reporting, companies should allocate emissions from upstream suppliers using a structured, data-driven approach. The reporting company must obtain two key data points from each supplier: (1) total supplier greenhouse gas (GHG) emissions at the facility or business unit level, and (2) the reporting company’s proportionate share of the supplier’s total production. The allocation can be determined based on physical factors (e.g., units of production, mass, volume) or economic factors (e.g., revenue, expenditure on supplier products).

Our Floodlight platform provides verified emissions data at the supplier level, ensuring that reporting entities can accurately attribute their share of upstream emissions. To establish the correct allocation, companies must provide the amount of goods or services purchased from each supplier, while external data sources will be used to determine the supplier’s total production volume. This approach ensures methodological consistency across the reporting company’s emissions inventory while maintaining supplier confidentiality and operational feasibility.

By adopting this rigorous emissions allocation methodology, companies can enhance the accuracy and comparability of their Scope 3 disclosures, align with global reporting standards, and demonstrate their commitment to supply chain decarbonization. This strategic approach not only facilitates regulatory compliance but also strengthens corporate resilience, improves investor relations, and positions businesses as leaders in climate accountability.

[1] https://cdn.cdp.net/cdp-production/cms/reports/documents/000/007/834/original/Scope-3-Upstream-Report.pdf

[2] https://ww2.arb.ca.gov/sites/default/files/2024-12/ClimateDisclosureQs_Dec2024.pdf

[3] Johnson, K. C. (2023). California’s ambitious greenhouse gas policies: Are they ambitious enough?. Energy Policy, 177, 113545.

[4] Gopal, S., Kelly-Fair, M., & Ma, Y. (2023, July). Palm Oil–The Increasing Materiality of Deforestation and Biodivievisity Risks in Indonesia and Malaysia. In IGARSS 2023-2023 IEEE International Geoscience and Remote Sensing Symposium (pp. 2374-2377). IEEE.

[5] https://www.ft.com/content/3f638e29-4790-4a10-b5b7-a79f9ef55491

[6] https://www.reuters.com/world/africa/us-open-minerals-partnerships-with-democratic-republic-congo-2025-03-09/

[7] https://www.reuters.com/world/africa/us-open-minerals-partnerships-with-democratic-republic-congo-2025-03-09/